Tuesday, March 23, 2010

My Ovary Hurts When I Walk

The economy can survive without his vital organs?

In my case, I am fascinated by this American desire to hide the truth. Indeed, we argued that financial markets are getting better and can start moving forward again. Remember that financial markets are infested with bad loans whose epicenter was Fannie Mae and Freddie Mac (which were nationalized by the U.S. government) and that the shock waves have spread through the failure of insurer AIG (which was supposed to ensure all claims questionable due to the famous CDS (credit default swap) ...). Therefore to take the pulse of the market we just look at how changing the institutions mentioned above. So here is what it appears to the first quarter of 2010

:

For Fannie Mae:

In all of 2009, total losses amounted to 74.4 billion against $ 59.8 billion in 2008.

The Federal Housing Finance Agency, regulator of Fannie Mae, requested an additional $ 15.3 billion to the Treasury, bringing the total support of the public at $ 76.2 billion.

Eighteen months after his rescue by injecting 182 billion dollars of public funds, the U.S. insurer has yet recorded a net loss of $ 10.9 billion in 2009.

Q1 loss is virtually the same as the annual loss.

in banks: U.S. authorities announced Friday, Feb. 22 closure of two U.S. banks, one in Nevada and one from Washington state, bringing to 22 the number of bankruptcies banking institutions since the beginning of the year in the United States.

The FDIC said this week that the number of U.S. banks 'problem' had leapt by 27% in the fourth quarter of 2009, rising to 702, the highest level since 1993, which indicates that the recovery U.S. banking sector remains uneven.

Since January 2008, 187 U.S. banks went bankrupt. U.S. authorities have already estimated that 2010 would probably be the year the number of failed banks would be at its peak.

"These figures are slightly above expectations. That said, given the huge quantities of stocks, real estate is not yet out of the woods," said Jack Ablin, Investment Officer at Harris Private Bank. "

It a little fun of the world, so Wall Street rises because the real estate collapse completely, but less than expected and so it justifies the U.S. indices recovered either as the pre-crisis knowing that no financial problems have been solved ...

In conclusion: There

increased losses in all financial institutions that are at the heart of the financial system. The U.S. strategy is to hide the reality and artificially increasing the monetary aggregate M2 is to flood the financial markets liquidity praying that the situation improves. (I speak for all this in detail in a forthcoming article). However, this strategy is expensive and the revenue of the U.S. state (such as European countries) have declined steadily forcing countries into debt again and again to finally receive almost imperceptible effects. We can then make the following two observations: -When a car engine broken it is useless to repair the body, it does not mean walk again. -The belief that the debt market is infinitely expandable to experience the same purpose as the same belief in the real estate market. All

the question is how long this strange situation will last. However, we are sure that this does not exceed a few years simply because in a year or two states will be companies to refinance their debts and unbearable it may be extremely risky.

Alexandre Letourneau

Monday, March 1, 2010

Dune Buggy Primary Games Cheat

Economic news: The rebound of U.S. GDP in the 4th quarter in detail.

T3: 3 rd quarter

T4: 4 th quarter

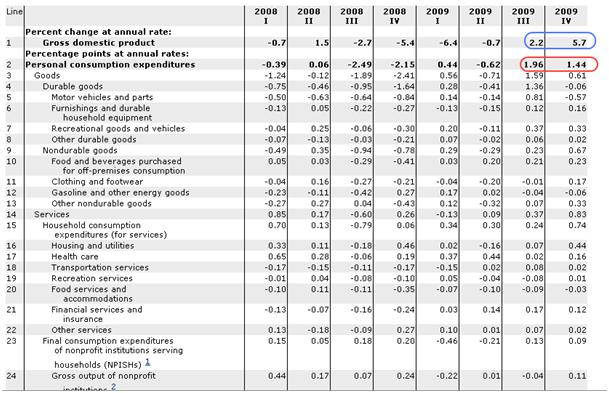

Here is the first published account by the U.S. Treasury on GDP growth to 4 th quarter and throughout the year. The 1 st thing that strikes us is the strong GDP growth in an era estimate to 4 th quarter rising to 5.7 points.

But that figure hides

information we will try to decipher. First keep in mind that the 1 st But that figure hides

estimate of 3 rd quarter was 3.7 points before finally being revised to 2.2 points.

Then I am very surprised at some comments in the press who speak of "continuous growth started at 3 rd quarter. Now we observe a interesting thing: growth of 4 th quarter was not all the same source as the growth of 3 rd quarter.

Indeed on the 3 rd quarter is observed that only consumption (it is red on the previous document), which is GDP growth. This is quite normal as in normal consumption constitutes 66% of U.S. GDP.

However the 4 th quarter, consumption was much weakened and does just that 35% of GDP growth. (2.2 points on 5.7 points.)

Thus there is a complete change in the structure of GDP would now be supported by investments which represent 51% of the GDP growth. (2.9 points 5.7 points.) Table 1.1.1. Percent Change From Preceding Period in Real Gross Domestic Product

Residential: refers to housing.

Non Residential: refers to property other than housing, such as office buildings, shopping centers, industrial parks, churches and hotels.

The 1 st table shows the percentage change compared to the previous period of each of the various items constituting the U.S. GDP. I highlighted in red and all the figures on which I wish to draw attention.

In the post

In the post

consumption we observe the following things:

- Consumption of durable goods rose by 20.4% to -0.9% Q3 to Q4. In the position of Investment:

-There is a jump in investment in the composition of GDP compared to the previous period from 5% to 39.3%. -

There is an increase in non-residential investment rising from 18.4% to 15.4%. Table 1.1.4. Price Indexes for Gross Domestic Product

can even remarked, all medium-sized banks do not have access to credit or liquidity by the FED. Thus, for the year 2009 120 banks went bankrupt and since the beginning of 2010, 20 have suffered the same fate. (Out of 20 banks, a good portion had assets totaling over 1 billion dollars).

Table 1.1.6. Real Gross Domestic Product, Chained Dollars

This table is important because it highlights the importance of consumption in the U.S. GDP.

Thus the 4 th quarter, we see that consumption is 9.298 trillion of the $ 13.155 trillion GDP. Thus all the speeches I have read as "Wall Street does not need to use his wealth "are absolutely false. The figures tell us that without consumption, the U.S. GDP would lead to a very severe decline.

In the 2 following tables detail I sought positions in the consumer investment. (The 1 st for consumption, the second for investment)

Table 1.5.2. Contributions to Percent Change in Real Gross Domestic Product, Expanded Detail (1)

In the durable goods category: -

This shows that consumption of American cars is declining in the composition of GDP fell to 0.81 -0.57 cons above. This is surprising given the measures of scrapping. One possible reason is the absorption of car market share by foreign automakers. (Especially Toyota which probably explains how hard she is a victim.) In the category of non-durable goods: -

There is an increase Non-durable goods in the composition of GDP increased by textiles and by the category called "other assets". We regret the lack of detail in this category represents a large part of the increase in nondurable goods in the compositions of GDP. On services:

- They are growing significantly due mainly to the position "of public goods and department of housing "and the posts of health. The change in services is mainly due to rise to positions or the State is very present. Table 1.5.2. Contributions to Percent Change in Real Gross Domestic Product, Expanded Detail (2)

Residential: refers to housing.

Non Residential: refers to property other than housing, such as office buildings, shopping centers, industrial parks, churches and hotels.

Regarding non-residential property, there was a significant rebound in the post GDP growth primarily driven by equipment and software as well as hardware and everything related to it. quarter 2010. In addition, the trade balance figures look very clearly overstated, it seems very likely to be revised down to 2 or 3 nd nd estimate.

Table 3.9.1. Percent Change From Preceding Period in Real Government Consumption Expenditures and Gross Investment

Conclusion: This recovery in Q4 is accompanied by a rise in unemployment outside, under normal circumstances, the U.S. unemployment has only quarter lag to the economic recovery. We do not observe this phenomenon here since the takeover was supposed to have taken place in Q3. Indeed, at the end of Q4 unemployment rate is 10% and 18% if one includes discouraged unemployed. Presumably there is a windfall for companies' policies of cost savings (replacement of human workers by computer equipment) taking advantage of low interest rates (just large companies, SMBs are unfortunately left to their fate and their failures do not diminish). The very low interest rates have the effect of making less expensive one additional unit of capital in relation to an additional unit of work. Therefore, for this reason that we observe an increase in investment in the composition of GDP but a parallel increase in unemployment, higher savings and lower consumption in the GDP composition. The recovery of the U.S. economy seems very fragile as highlighted in the Obama adviser, Larry Summers, who speaks of "a simple return statistics." Finally, finally, the figures seem clearly overestimated. It is therefore very likely to have once again a strong disappointment on GDP growth.

Alexandre Letourneau

Subscribe to:

Posts (Atom)

I must confess that I am a little surprised at the current economic climate. Even if politicians have with more and more difficult scenario than one occasion, the general climate is not very good. Indeed, Many economists are beginning to worry about a crash to come on the debt market while journalists questioned the fact that this recovery is assumed to correlate to an unemployment rate that does not completely abated. (And I spend all concerns about Greece, Portugual, Spain etc ... which I think I mentioned already last summer ... it say if the subject is old)

I must confess that I am a little surprised at the current economic climate. Even if politicians have with more and more difficult scenario than one occasion, the general climate is not very good. Indeed, Many economists are beginning to worry about a crash to come on the debt market while journalists questioned the fact that this recovery is assumed to correlate to an unemployment rate that does not completely abated. (And I spend all concerns about Greece, Portugual, Spain etc ... which I think I mentioned already last summer ... it say if the subject is old)